UK economy warned of recession as interest rates soar

UK economy have been warned by The Bank of England as higher energy prices will push inflation above 10 percent, and this will cause a slide into recession this year.

The cause of a major economic crisis can come from several different impacts. Some are triggered by war while others by government policy measures. In general, the recession is caused by economic imbalances, but not only the economy struggles during a recession, people lose work, companies make fewer sales and the affected country’s whole economic output declines. This major decline in economic activities can last for months, but even years.

The decline in economic activity is mostly measured by the following 5 indicators: GDP (gross domestic product), real income, employment, industrial production, and retail trade. However, there are other, even more visible indicators, such as the bankruptcy of businesses, frequent price reductions in stores due to low consumer spending, falling house prices, and high unemployment rates.

GDP attempts to summarise all the activity of companies, governments and individuals in an economy in a single figure.

? Breaking news: The Bank of England has warned that the UK economy will slide into recession later this year as higher energy prices push inflation over 10% and cause the worst squeeze in household finances for many decades https://t.co/7fn32D04cy

— Financial Times (@FinancialTimes) May 5, 2022

On Thursday, the bank’s Monetary Policy Committee voted for raising the main interest rate from 0.25% to 1%, and this is the highest level since 2009. Out of the nine MPC members, three of them voted for a half-point rate increase. This is designed to curb the inflation which could go above 10%. This will affect mortgage holders and cause to feel the immediate impact, and unfortunately could be followed by more increases.

Bank governor Andrew Bailey said:

“It is a very weak projection, a very sharp slowdown, there’s a technical definition of a recession it doesn’t meet – but put that to one side – it is a very sharp slowdown in activity.”

Furthermore, this will put a huge impact and causes other issues on the economic savers.

Sarah Pennells, Consumer Finance Specialist at Royal London said they are being hit with a “double whammy”.

“Those who can leave their savings untouched will still lose money in real terms, despite today’s rate rise, because the return on cash held in savings is significantly below the current high level of inflation. The rise in the cost of living, outpacing the rise in wages, is also forcing others to dip into their savings, with a quarter of full time workers in the UK looking to access some or all of their short term savings to help them get by day to day.”

There are other affected population members, such as small business owners and some have also expressed concern after the news of recession. They described the situation as a “nightmare scenario” which is “crippling millions of people and small independent businesses.”

Inflation in the UK is being driven by the wealthy who can pay higher prices. The Bank of England has rewarded them by increasing interest rates today, increasing their incomes, whilst charging those on low pay more. This does not solve inflation, but it does increase inequality

— Richard Murphy (@RichardJMurphy) May 5, 2022

By 2025, recession might cause the unemployment to rise from 3.8 per cent to 5.5 per cent. The MPC also expects the UK economy to recover only weakly from the next recession, suggesting that the economy would not be able to withstand growth well above 0.6 per cent a year without a resurgence of inflation.

Karen Ward, a markets strategist at JPMorgan Asset Management, said the following:

“The combination of the pandemic and Brexit has changed the fundamentals of the UK economy — particularly its ability to generate persistent inflation. The bank will have to keep raising rates to bring inflation down, but a gradual approach, as taken today, is understandable,”

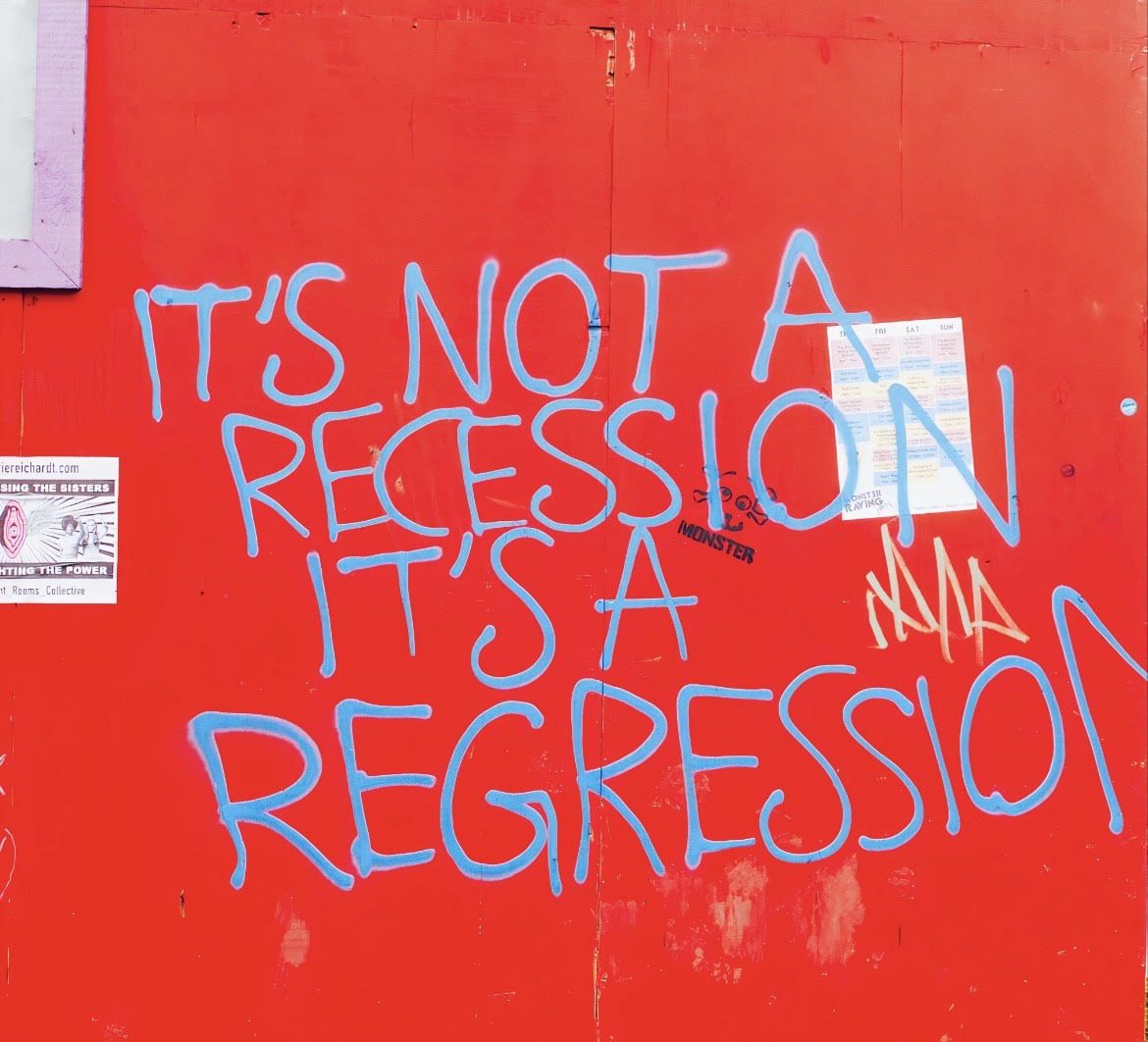

Featured Image Credit: Christopher Bill, Unsplash