New Bill to protect mortgage ‘prisoners’ brought to House of Commons

A new bill to free mortgage ‘prisoners’ trapped in expensive deals is being proposed today (May 7).

The Bill will allow consumers to change mortgage providers without incurring expensive transfer costs.

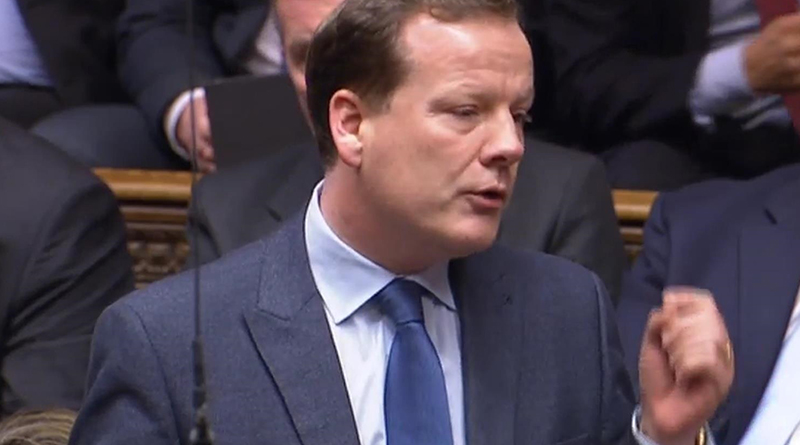

Charlie Elphicke, MP for Dover, is introducing the Banking (Consumer and Small Business Protection) Bill in a Ten-Minute Rule motion in the House of Commons.

It aims to help up to 200,000, what Elphicke calls ‘mortgage prisoners’ across the UK impacted by affordability tests brought in after the financial crash.

The new laws would exempt reliable borrowers from the affordability tests payments – and ban the Treasury and lenders from selling mortgage deals to unregulated ‘vulture funds’.

Elphicke is calling on Parliament to establish a Financial Services Tribunal and prevent the foreclosure of business loans.

Mr Elphicke said: “The new laws would exempt reliable borrowers from the affordability tests payments – and ban the Treasury and lenders from selling mortgage deals to unregulated funds.”

Introducing the Bill, the MP told the Commons: “It’s time to set the mortgage prisoners free.

“Every one of these 200,000 families affected has a story of how they have struggled to get by. Struggled to meet expensive payments to keep a roof over their heads.

“It’s insulting for them to be told they cannot afford to pay less.

“The Government should be lending a helping hand, not a tin ear. Capitalism is vital to the success of our economy and a cornerstone of our way of life.

“Yet we know that it must be tempered by responsibility and fairness. We want people who work hard to be able to enjoy success. Yet we will not tolerate people being taken advantage of.”

The Banking (Consumer and Small Business Protection) Bill aims to protect small business borrowers and create a new Financial Services Tribunal.

Currently business loans above £25,000 are unregulated and the bill would ban the practise of seizing on technical loan condition breaches where borrowers are up to date with payments.

Elphicke told the Commons: “Small businesses are the lifeblood and job creators of our economy.

“Every time a small business closes, part of our economy dies.

“We need to see them treated fairly so they focus on doing what they do best – creating jobs and making our country stronger and more successful.”